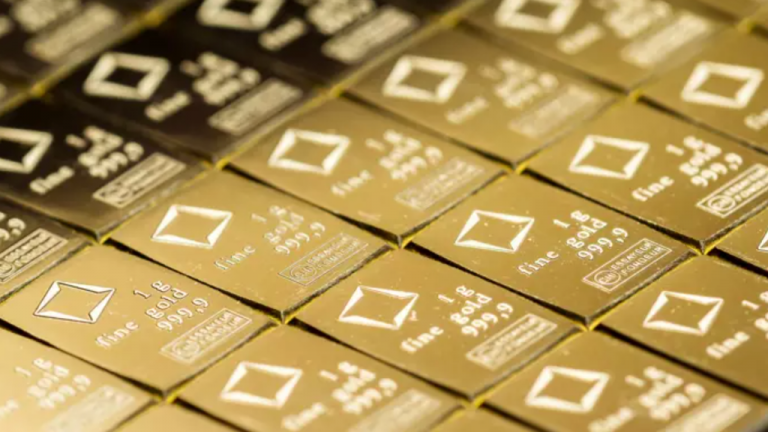

Gold Price Prediction – Gold Markets Continue to Pose a Breakdown Danger

Tuesday’s trading session saw a slight decline in the gold market, as it continues to appear that the market is close to breaking down.

Tuesday’s trading session saw a slight decline in the gold market, as it continues to appear that the market is close to breaking down.

The natural gas market has exhibited indications of life over the past few days, hovering around $7.80. This is an area where we’ve already seen support, so I suppose it’s not surprising.

Tuesday’s crude oil markets experienced a mildly unfavorable trading day as traders pondered their next move.

During Tuesday’s trading session, silver markets retreated a touch as we hover near the 50-day exponential moving average.

A study undertaken on behalf of the NCDEX Investor Protection Fund reveals that suspension of their futures does not reduce price volatility.

In early trade, the gold of 10 grams of yellow metal (24-karat) stayed constant at Rs 51,000.

After shattering a support line that had held for two months, the gold price has continued to decline and is now within striking distance of an annual low. The XAU/USD bears are optimistic due to firmer yields and worries about China. The US retail sales report is being anticipated with caution after lower than expected CPI and PPI failed to calm hawkish Fed predictions.

Oil prices inched higher on Thursday as the market weighed weak demand against supply disruption due to an impending train slowdown in the United States, the largest petroleum consumer in the world.

The world is experiencing the very first Global Energy Crisis. In the 1970s, there was an Oil Crisis; presently, there is an Oil Crisis, Natural Gas Crisis, Coal Crisis, and Electricity Crisis simultaneously.

Tuesday’s gold markets plummeted as the CPI number was far higher than anticipated. Nevertheless, we are nearing a big support level.