10 Best Wheat Stocks Every Trader Should Consider in 2022

This article discusses ten wheat stocks to purchase today, as well as a comprehensive examination of the situation of wheat and agricultural commodities during the Russia-Ukraine conflict.

This article discusses ten wheat stocks to purchase today, as well as a comprehensive examination of the situation of wheat and agricultural commodities during the Russia-Ukraine conflict.

Crude oil prices have fluctuated wildly this week, wiping out accounts at every opportunity. Since this is the case, you should generally avoid this market for the time being.

The silver market has fallen this week, particularly on Friday. Now that we are much below the $20 threshold, it appears that silver has further to fall.

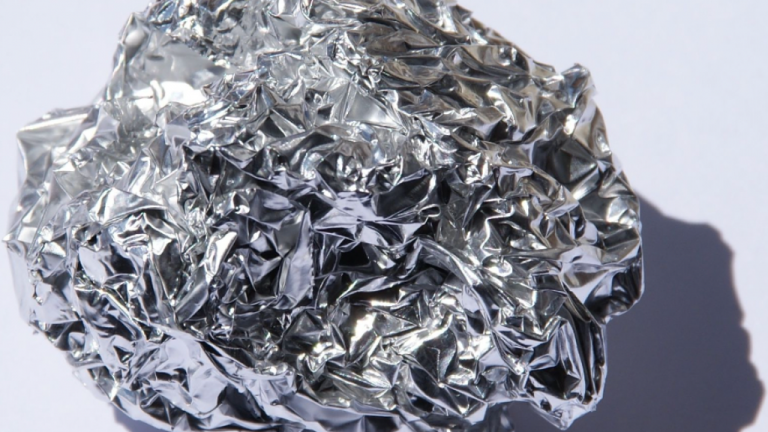

Aluminum may be used in a variety of ways. Aluminum is used to hold beverages, create buildings, fly airplanes, and propel vehicles. The global aluminum demand is anticipated to increase at a compound annual rate of 5% through 2026, owing to its widespread application. In addition to a resurgent global economy in the wake of the COVID-19 pandemic, this prognosis is influenced by increasing infrastructure expenditure. Consequently, investing in aluminum stocks may be prudent.

The gold price is hanging at $1,800.00, and a decline is imminent as the DXY recovers. Fed Powell cannot provide an assurance that the inflation rate would fall to 2 percent. On the ISM PMI front, investors anticipate a lackluster showing.

WTI recovers from its largest daily loss in a week near key support. Bearish MACD signs, a declining RSI, and the inability to breach the 21-day EMA all favor selling. The convergence of the two-month-old support line and the 100-day exponential moving average inhibits additional declines.

As of Thursday’s trading session, the silver market has broken below the $20.50 barrier, resulting in a major decline.

The gold market fluctuated during trade on Thursday, as the important $1800 barrier continues to be threatened. The $1800 level is a support region that is reinforced by a substantial rising line.

The oil and gas business has undergone substantial volatility over the past several years, causing energy investors to question whether oil firms — even the leading oil corporations — are wise investments at the moment. Let us delve further to see if oil and gas investments are suitable long-term investments that belong in your portfolio.

The decline in Treasury rates is an indicator that some speculators are banking on a recession. However, we do not observe the similar betting activity on the gold market.