Crude Oil Price Prediction – Slumping Crude Oil Markets

Bear in mind that it was Juneteenth in the United States, meaning that significant liquidity was absent, as crude oil prices fell marginally during Monday’s trading session.

Everything you need to know about gold news.

Bear in mind that it was Juneteenth in the United States, meaning that significant liquidity was absent, as crude oil prices fell marginally during Monday’s trading session.

Monday’s trading session for silver markets has been characterized by a lack of movement as hesitancy continues.

As yields decline, the gold price maintains its position above the crucial support of $1,850.00. The 10-year US Treasury rates have fallen below 3.20 percent following the Fed’s announcement of a massive rate rise. Today’s speech by Fed head Jerome Powell is anticipated by investors.

Silver receives offers to reach a new daily high for the first time in three days. Before the weekly resistance line and the critical SMA confluence, the monthly horizontal resistance area pushes buyers. MACD and RSI indicate a continuation of the uptrend, while the 78.6 percent Fibonacci retracement level prevents additional losses.

Gold’s price is encountering resistance at $1,820 per ounce, although the recovery appears more robust amid a risk-taking disposition. Investors have begun to assume that a 75 basis point rate rise is coming. Yields on 10-year US Treasuries have plummeted to 3.42 percent.

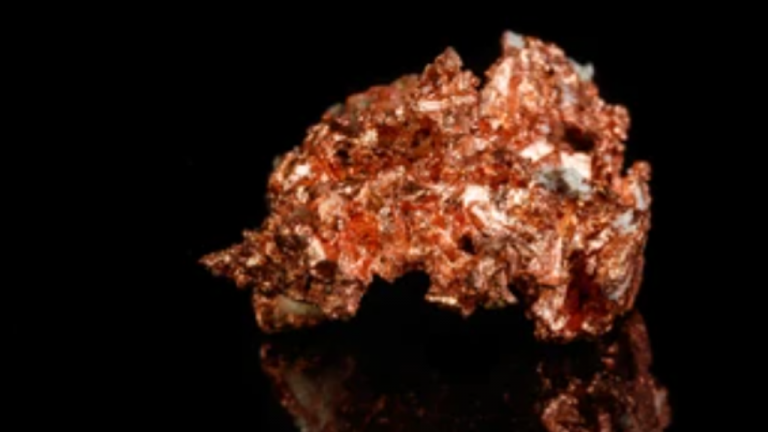

On the heels of positive data from China, copper prices are anticipated to resume their upward trend. China’s Industrial Production has turned positive, rising to 0.7% from -2.9% previously reported. The higher CPI announced last week supports the anticipation of a 75-bps rate rise by the Fed.

During Thursday’s trading session, the natural gas markets reached the bottom of the broad consolidation range we have been in.

During Thursday’s trading session, the gold market reached the bottom of the general consolidation region. Given that we are awaiting CPI data on Friday, it seems reasonable that gold would be volatile.

Natural gas prices reached new heights. The South is anticipated to have above-average temperatures. The amount of U.S. natural gas coming at LNG facilities remains rising. On Monday, natural gas prices skyrocketed, surpassing 13-year closing highs.

The market behavior over the previous two sessions implies that gold investors are pricing in an aggressive path of Fed interest rate rises.