Silver Price Forecast – Silver Stabilizes

The 200-day exponential moving average (EMA) has been maintained by silver throughout Wednesday’s trading session.

The 200-day exponential moving average (EMA) has been maintained by silver throughout Wednesday’s trading session.

Monday’s trading session saw a little decline in crude oil prices, as the commodity continued to appear relatively weak.

The silver market has exhibited a great deal of volatility over the past few days, initially falling on Monday before being repurchased.

Monday’s trading day began with a decline in natural gas prices, but the markets soon showed signs of life again. By doing so, the market appears to be attempting to achieve the above-mentioned key moving averages.

It appears that the trend line is attempting to reestablish its significance, as gold markets have retreated somewhat during Monday’s trading session to begin off the week.

Gold markets have declined early in Thursday’s trading session, falling below the 200-day exponential moving average (EMA).

We continue to observe a great deal of erratic behavior on the natural gas markets throughout Thursday’s trading day.

Crude oil prices have suffered again on Thursday, as concerns regarding demand continue to cause severe challenges for this sector.

The silver market has declined during Thursday’s trading session to test the 200-day exponential moving average. In this manner, the market appears to be questioning the trend.

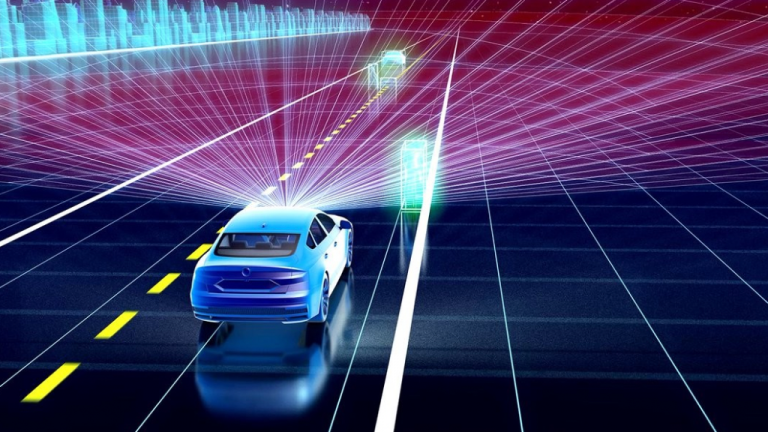

Lidar is undeniably one of the most intriguing technological advancements of the twenty-first century. This abbreviation for “light detection and ranging” enables computerized systems to generate 3D landscape models. This technology permits varying distances to measure, making lidar equities attractive to investors.