Gold is one of the most frequently traded precious metals, but when is the optimal time to sell gold? Here, we discuss the trading hours of several gold exchanges and describe the various methods for trading gold.

When Do Gold Markets Trade?

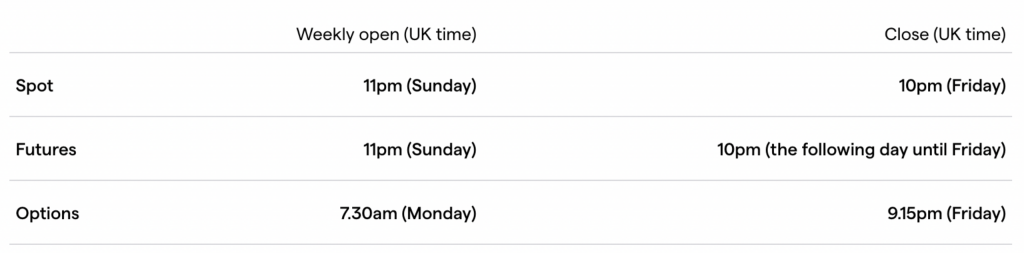

The trading timeframes of gold markets vary depending on whether spot, futures, or options prices are being traded. IG provides CFD trading on spot gold prices between 11 p.m. Sunday and 10 p.m. (UK) Friday during our usual market hours.

CFDs are also available for gold futures speculation. Our gold futures trading times are 24 hours, five days per week, except from 10 p.m. to 11 p.m. (UK time).

Top1 Markets provides CFD trading on daily options for trading gold options between 7.30 a.m. and 9.15 p.m. Monday through Friday (UK time). In addition to daily options, we also have weekly and monthly options.

CFDs let speculation on the price of gold without requiring ownership or delivery of the underlying asset. This implies they may be used to speculate on the price of gold growing (by going long) as well as dropping (by going short) (by going fast).

When Is the Right Time to Invest in Gold?

There are several instances in which a trader may choose to take a position in gold. This is because the market price is governed by global political and economic factors, which can induce supply and demand swings. An increased supply with consistent demand will result in lower pricing, as would a decreased supply with continuous demand.

Nonetheless, many traders acknowledge that gold is a safe-haven asset, meaning that in economic instability, its value remains stable or may even rise. This is because an increasing number of market players will choose to deposit their funds in gold instead of other assets, causing demand to exceed supply.

What Methods Are There for Trading Gold?

- There are four basic ways to trade gold: spot trading, futures trading, options trading, and direct investment in gold.

- Spot prices allow you to speculate on the current value of gold on the market.

- You can bet on the price of gold futures growing or dropping through futures trading.

- Trading gold options involves taking a position on a contract price for gold options.