Natural gas is among the most frequently traded commodities. Due to its extreme volatility, it offers several chances to traders. Learn how to change natural gas, the factors that determine its price, and some practical trading tactics.

Table of Contents

Natural Gas Trading Fundamentals

Natural gas is the second most common kind of energy used to create electricity, accounting for 22 percent of the world’s electricity production in 2017.

In the last decade or two, the rising use of natural gas in emerging nations such as China and Indonesia has sustained its appeal.

Natural gas is utilized to heat houses, boil water, fuel automobiles, cook meals, operate air conditioning systems, and fuel industrial furnaces. Household equipment, such as gas ranges and radiators, converts the energy provided by natural gas into heat.

Henry Hub Natural Gas (NG) futures traded on the Chicago Mercantile Exchange are the industry standard (CME Group). A natural gas pipeline in Louisiana named Henry Hub, which serves as the official delivery place for futures contracts, is the name’s source. The natural gas futures contract is the third-largest physical commodities futures contract globally in terms of volume.

World’s Largest Natural Gas Producers

In contrast to oil, which may be found in large quantities below the earth’s surface, natural gas is frequently trapped in rocks and silt. Typically, extraction firms utilize a technique known as hydraulic fracturing, or fracking, in which water, chemicals, and sand are blasted deep into the soil to extract natural gas.

What Affects the Price of Natural Gas?

As with other commodities, natural gas prices are determined by supply and demand. The stored reserves, worldwide consumption, the development of other fuels, the costs of alternative fuels, and the weather are essential elements influencing the supply and demand for natural gas.

In essence, if more people want to purchase natural gas than sell it, the price will rise since it is in more demand (the “demand” exceeds the “supply”). In contrast, if supply exceeds demand, the price will decrease.

Inventories of Natural Gas

Many nations worldwide have natural gas reserves for usage in the case of a supply surplus. By storing natural gas, governments attempt to mitigate some of the issues associated with increasing prices during periods of decreased supply.

By storing natural gas, countries will not need to purchase as much during a supply deficit, temporarily reducing demand. However, suppose a country’s reserves are exhausted or depleted. In that case, it will need to purchase more, which, in the event of a shortage, will result in higher costs to compensate for the decreased supply of natural gas.

Global Demand

The global demand for natural gas has increased substantially during the past decade. In the next five years, it is anticipated that the demand for natural gas will increase by around 1.6% each year, with the majority of this increase coming from expanding Asian economies.

However, the United States is still the largest natural gas consumer globally, followed by Russia, China, Iran, and Indonesia. Uncertain is the rising worldwide demand for natural gas will have on pricing. If increased production in Qatar and the United States can meet the expanding market, prices may not be significantly impacted.

Construction of Alternative Energy

The growth of cleaner alternatives to fossil fuels might reduce the cost of natural gas. It is anticipated that the world population will become less dependent on fossil fuels such as natural gas in the future years.

Cost of Alternative Energy Sources

Natural gas consumption will decrease if other fuels are less expensive than natural gas. This might occur if oil is overproduced or if governments devote more resources to constructing nuclear power plants and wind farms, hence reducing the cost of these alternative energy sources.

Similarly, less natural gas will probably be extracted if the government imposes further limits on hydraulic fracturing. Therefore, the price will rise in comparison to alternative sources of energy generation, such as renewable energy and nuclear power. In response to popular resistance, several nations, including Ireland, Germany, Australia, Scotland, and Uruguay, have already permanently or temporarily outlawed fracking.

Weather

Extreme weather can render natural gas production centers inoperable for days or even weeks, such as hurricanes and storms. This indicates that reserves will diminish when supply is consumed, resulting in a price increase.

Similarly, freezing winter weather might prompt more individuals to increase their houses’ heating. This would indicate that more natural gas is being consumed to meet growing demand, resulting in a price increase.

Methods for Trading Natural Gas

Future Contracts

Traders take positions on natural gas most frequently through futures contracts, such as the Henry Hub natural gas futures contract on the CME. Traders commit to delivering a specified quantity of natural gas at a future date and for an agreed-upon price via a futures contract. Nonetheless, this may require the trader to take possession of the asset finally.

Options

In addition to futures, traders may speculate on the price of natural gas using options. There are two types of options: puts and calls. Both provide traders the right, but not the responsibility, to purchase or sell an underlying asset before a specified expiration date.

Contracts for Distinction (CFD)

CFDs allow you to bet on natural gas price swings without actually acquiring the underlying asset. With a CFD, you agree to swap the price difference between when the contract is opened and closed.

CFDs can serve as an efficient hedge for your other active positions because you can go short or long, allowing you to profit from dropping and rising markets.

Strategies for Trading Natural Gas

Prices for energy-related commodities, such as natural gas and oil, have been historically unpredictable due to the multiple variables that might alter their supply and demand levels. As a result, the most powerful trading methods for the natural gas market capitalize on small-time gains, such as day trading, as the price of a long-term position might turn against you overnight.

Day Trading Strategies

Due to the market’s significant volatility, day trading might be an effective method for natural gas price speculation. Traders that employ a day trading strategy strive to generate tiny returns on many deals throughout the day, which necessitates persistent market monitoring within a single trading session.

Therefore, day trading is best suited for those with a great deal of time to devote to the markets and the ability to pay close attention to news items and other events that might impact the price of natural gas.

Range Trading Strategies

In a range trading strategy, a trader attempts to purchase at levels of support and sell at levels of resistance in an asset’s price fluctuations. Range techniques operate well in markets with frequent price fluctuations and no discernible long-term trend.

This makes it a viable technique for use in the natural gas market if traders can correctly identify support and resistance levels.

Breakout Trading Strategies

Breakout trading is a different profitable approach for extremely turbulent markets, and its success depends on a trader identifying a price increase in its earliest phases. Consequently, a trader will buy low and sell high after an asset’s price has “broken” above a historical resistance level.

Breakout traders can also establish a short position when the price of an asset “breaks” below a historical level of support; therefore, this trading approach can be employed in both rising and falling markets.

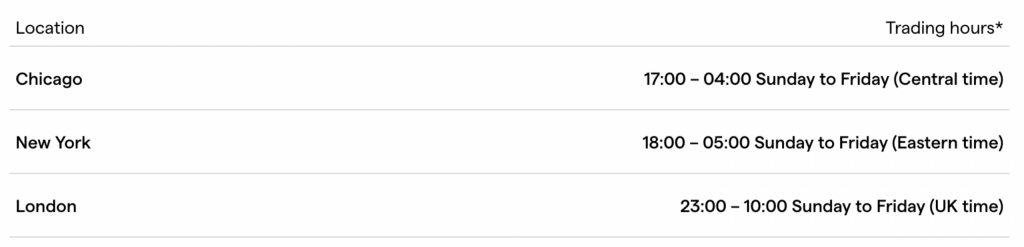

Hours of Natural Gas Trading